tax strategies for high income earners canada

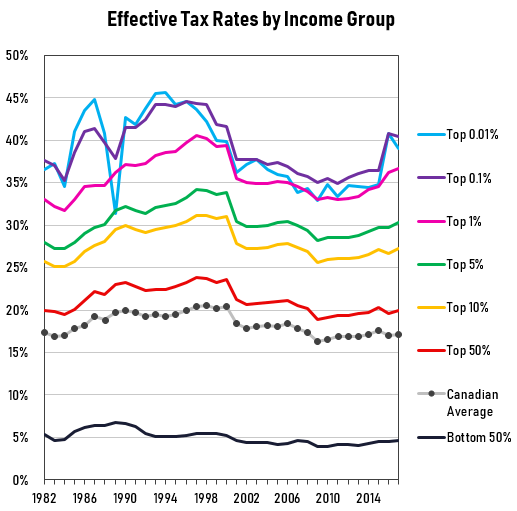

Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible individual pension. When personal income exceeds 200000 in canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence.

Tax minimization strategies for.

. The more money you make the more taxes you pay. Similar to income splitting this strategy may lower the overall tax obligation for a family and may be suitable for higher income. Just as your ambitions are uniquely your own so too is your tax situation.

The math is simple. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. With your qualified tax advisor.

For many high-earning Canadians there may be specialized tax strategies that help preserve and grow their wealth. Here are some of our favorite income tax reduction strategies for high earners. Taking advantage of all of your allowable tax deductions and credits.

Ad Helping Businesses Navigate Various International Tax Issues. Here are a couple of tax planning strategies that will be highly effective for you. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount.

Lets start with an overview of tax rules for. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep. Estate planning for HNWI should be.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. All the investment income in the TFSA grows tax-free and future. Income tax is based on your taxable income not your total income.

For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep. Taxinvestment strategies for high-income Canadians. High income family members with surplus funds.

RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax. Tax planning strategies for high-income earners. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

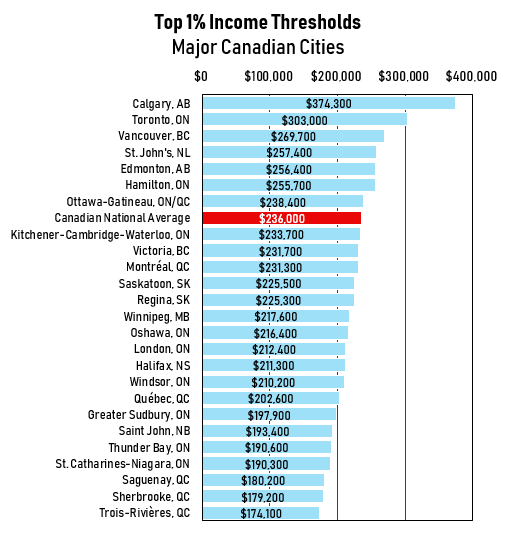

For the nations highest-income earners those making more than 220000 annually the amount. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government.

Overview of Tax Rules for High-Income Earners. Contact a Fidelity Advisor. Consulting and Scalable Services to Help Businesses with Foreign and International Taxes.

Utilize RRSPs TFSAs RESPs to the max. The first way you can reduce your taxable income and therefore your tax on that income is. Learn How EY Can Help.

Like most other places if you live or earn income in Canada you will have to pay income tax. Registered Retirement Savings Plans RRSPs. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

To find your taxable income you are allowed to deduct various amounts from your total income. Immediate Financing Arrangements IFA allow investors to capitalize heavily on an insurance contract by leveraging tax advantages. Tax deductions are expenses.

To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will. Canadian tax law allows for several ways to reduce your taxes owed if you know.

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

How Can A High Income Earner Reduce Taxes In Canada Cubetoronto Com

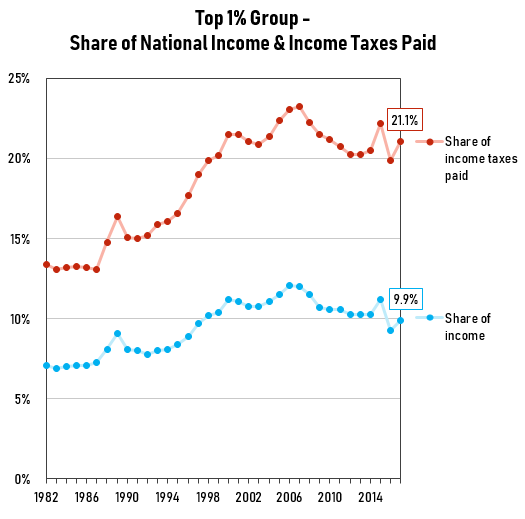

The Story Of The Rich Not Paying Their Fair Share Of Taxes Gis Reports

High Income Earners Need Specialized Advice Investment Executive

Tax Planning For High Income Canadians

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Tax Planning Strategies For High Income Canadians

How To Reduce Taxes For High Income Earners In Canada

How To Pay Less Tax In Canada 12 Little Known Tips

Over A Quarter Of Canada S Top Earners Barely Pay Any Tax Will A New Minimum Tax Help The Globe And Mail

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube