how are rsus taxed in the uk

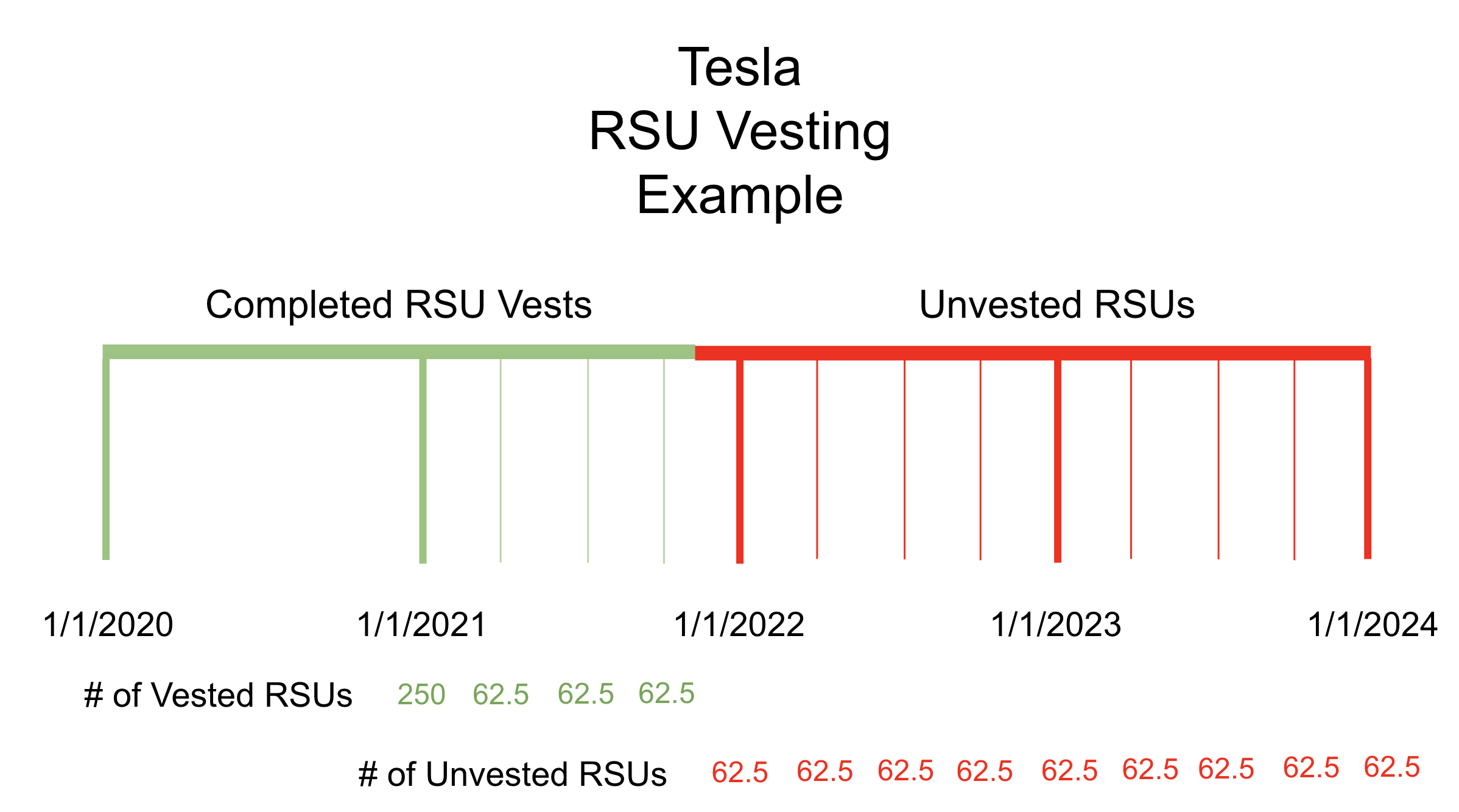

You only pay tax on RSUs when they vest. They were introduced in 2014 as an.

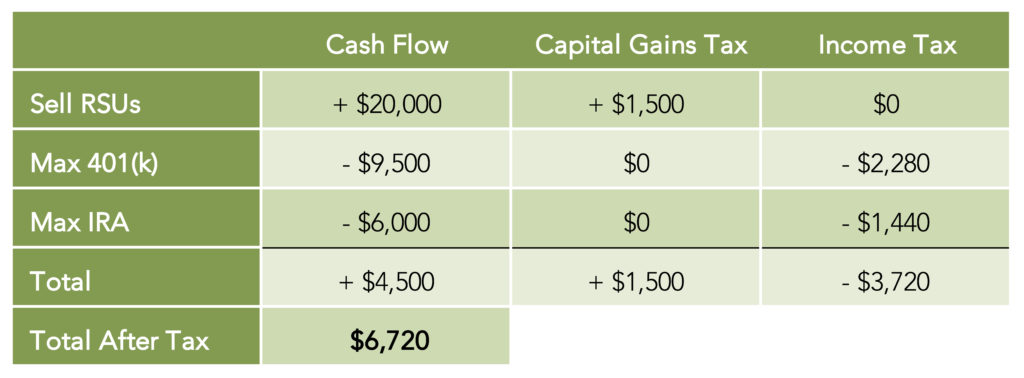

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

You may also need to pay for employers national insurance.

. Income from real estate located in Switzerland is subject to tax at the ordinary rates. The performancelinked award of six million shares to be executed through five tranches of 12-m shares till. The Freshworks board had okayed the award in a pre-IPO decision in September last year with a third of the nine million share award routed as Restricted Stock Units RSUs that began vesting with him beginning November last year.

Like other options schemes RSUs can be conditional and are subject to a vesting schedule. The performancelinked award of six million shares to be executed through five tranches of 12-m shares till. You can save tax and national insurance by sacrificing your bonus into your pension.

Rental income derived from investments is taxed at the ordinary rates together with the other income. ISOs arent taxed when granted upon vesting or when exercised. You will also pay national insurance at 2.

They can be structured rather like options but shareholders are taxed when the shares vest. Gaining free money through an employer match isnt the only way to benefit from a 401k. Israel with Substitute RSUs you are taxed as earned income when the Substitute RSUs vest and you receive the shares of DoorDash net of taxes.

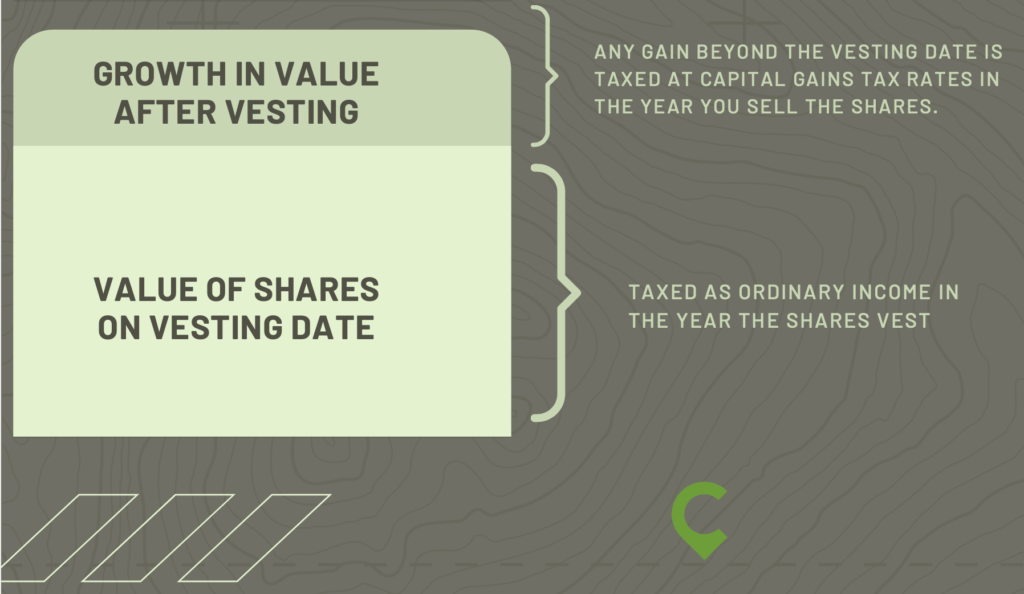

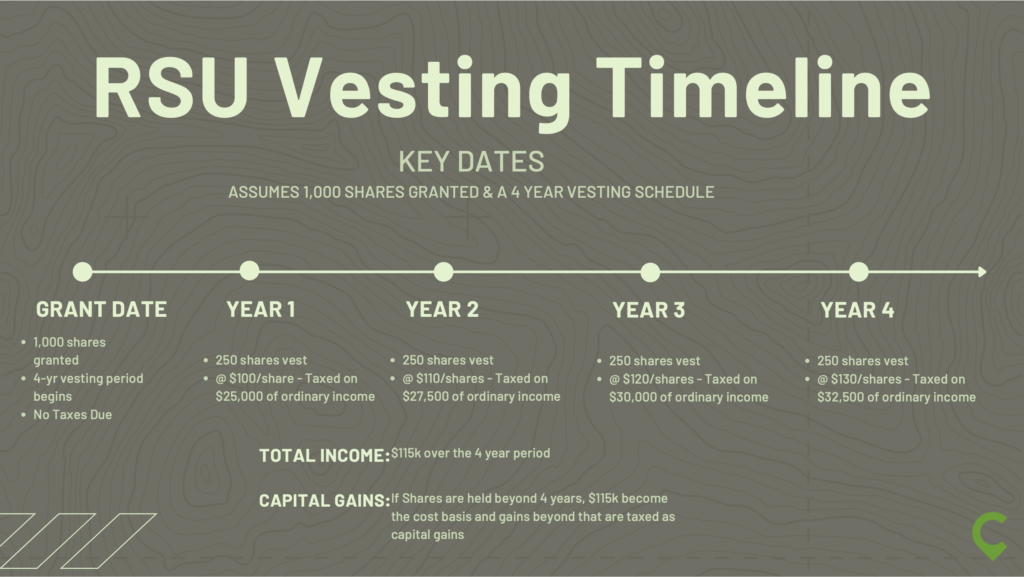

The recipient of a restricted stock unit will generally be taxed at ordinary income rates on the fair market value of the shares of the Companys common stock awarded on the transfer date. Taxation of Substitute RSUs is dependent on the country or countries you lived and worked in while you are vesting in your Substitute RSUs but generally except for certain countries eg. The UK tax treatment for RSUs is similar to how your salary is taxed.

For more information check out this article on how to save tax with bonus sacrifice. The owner of self-used real estate is deemed to generate income ie. If a Section 83b election has been made dividends will be taxed at dividend rates.

Gross profit was 55 million or 476 of revenue compared to 40 million or 487 of revenue in the same quarter of 2021. For example if you earn 100000 and receive a bonus of 12000 the bonus will be taxed at 60. RSUs are another way of issuing equity.

The employee can pay taxes similarly to an RSU award with the fair market value of the restricted stock. During the first quarter 2022 the Company generated 54 of its revenue from Australia 41 from the US and 5 in the UK Canada and other geographies. Employee owned trusts own controlling stakes in businesses on behalf of employees.

The more you contribute the more you reduce your taxable income which could potentially reduce how. Taxes are deferred until shares are sold and if you meet certain holding requirements ISOs are subject only to capital gains taxes. Foreign rental income is exempted with progression in Switzerland.

The Freshworks board had okayed the award in a pre-IPO decision in September last year with a third of the nine million share award routed as Restricted Stock Units RSUs that began vesting with him beginning November last year. The tax treatment of restricted stock awards comes down to a choice by the employee. In all cases there is no tax to pay when RSUs are granted.

When your RSUs vest you will pay income tax and employee national insurance.

A Guide To Restricted Stock Units Rsus And Divorce

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Rsu Taxes Explained 4 Tax Strategies For 2022

Switching From Options To Rsus Carta

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Taxes Explained 4 Tax Strategies For 2022

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta